Behind the Hot Year for Biofuels M&A: 2021 Review and Outlook

By Bruce Comer, Frank Kim and Zak Putlak, Ocean Park

Special to The Digest

As ethanol producers pursued mergers and acquisitions, and renewable diesel firms built and expanded plants, the biofuels industry increasingly focused on securing feedstocks. Producers seeking to consolidate, optimize or sell plants helped double the number of mergers and acquisitions in 2021 over 2020, including one of the biggest biofuel deals ever. Sellers sought to unload underperforming plants or to generate capital to reinvest in higher-value specialty ingredients or carbon capture projects. In the biodiesel and renewable diesel markets, instead of acquiring operating plants, the larger companies spent significant capital to build and retrofit plants, amplifying a frenzy of investment amid a battle for limited feedstock supplies.

The M&A splurge in ethanol was the most intense in five years. Four out of the five top ethanol producers were involved in a transaction in 2021. That included a big prize: the acquisition of Flint Hills’ ethanol business by POET, giving it 800 million gallons per year (MGPY) of additional capacity.

The story in renewable diesel (RD) and biodiesel (BD) was building, not buying. Petroleum refiners and biodiesel producers led a construction boom in renewable diesel, as 12 plants are either under construction, expanding or have been completed, accounting for 3.9 billion gallons and $7 billion-plus in investment through 2024.

One consequence of this expansion in RD is a feedstock shortage that affects vegetable oil, used cooking oil, corn oil and other lipids. Overall, vegetable oil is the primary feedstock used in RD and BD. Most new RD plants start operations using refined soy oil. They typically add on pre-treatment equipment to process waste feedstocks

The integrated oil companies’ and the independent refiners’ newly found interest in biofuels stems from their decision to generate compliance credits internally, repurpose older refineries, turn a profit, respond to shareholder pressure, invest in a high-growth market, and hedge with investments in promising carbon markets such as California and Oregon.

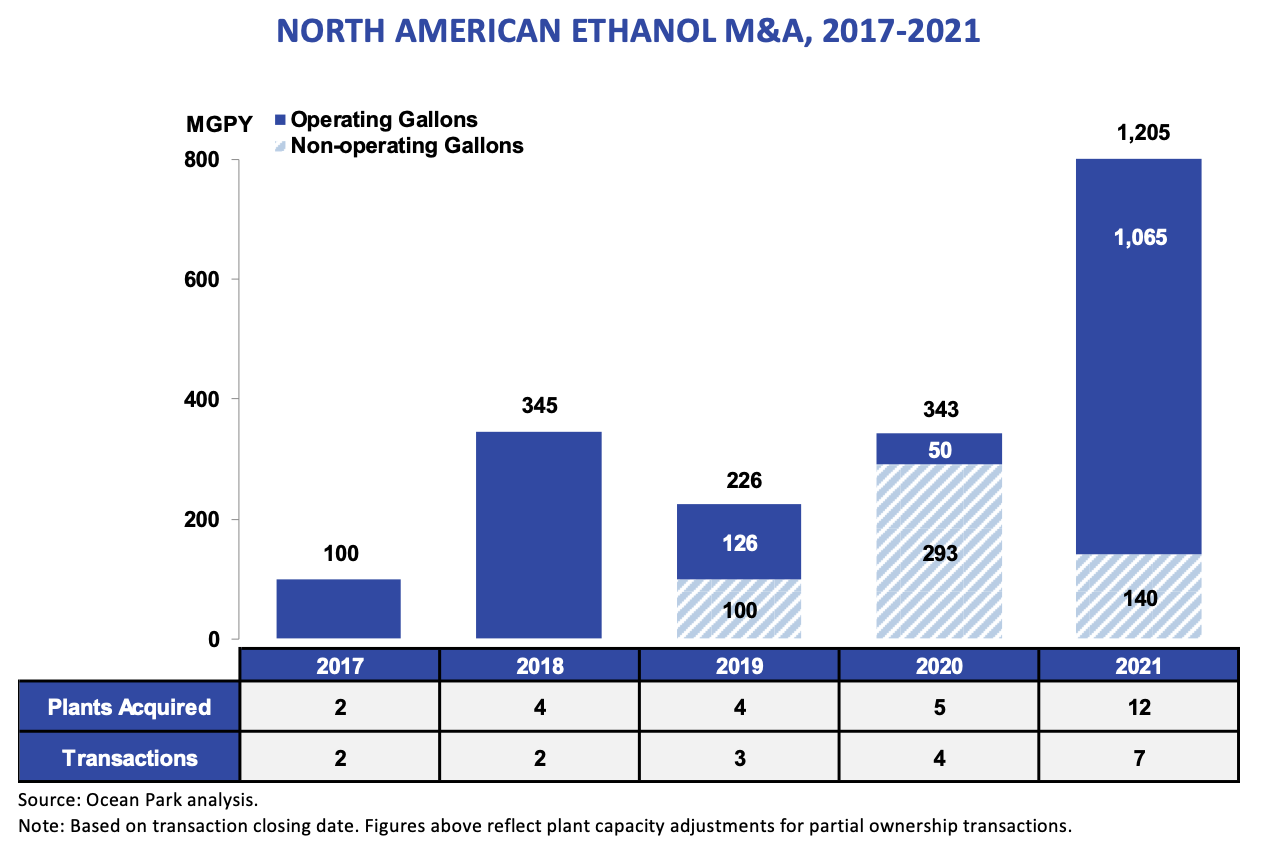

Ethanol M&A

Ethanol M&A rebounded strongly in 2021, nearly doubling the deal flow in 2020. A total of seven M&A transactions closed during 2021, the most since 2013. These transactions involved 12 plants with 1.2 billion gallons per year (BGPY) of capacity, representing 7% of total U.S. ethanol capacity. Of those 12 plants that were acquired, seven were large-scale operating plants, comprising 78% of all the capacity sold. The flurry of dealmaking broke a lull of two years where no large-scale operating plants traded.

The landmark transaction: POET’s purchase of Flint Hills’ ethanol business, which gave it 800 million gallons per year (MGPY) of additional capacity. Prior to the transaction, POET was already the largest US ethanol producer. Buying Flint Hills’ ethanol business, previously the 5th largest producer, POET now controls 17% of the industry capacity. That put Flint Hills, which sold a biodiesel plant in 2020, out of biofuels production.

ADM, Alto Ingredients and Green Plains also sold plants totaling 300 MGPY capacity, and plan to reinvest capital into high-value products or high-quality alcohols.

Seven transactions involved twelve plants with 1.2 BGPY of combined plant capacity:

- POET bought six ethanol plants from Flint Hills in the Midwest and two ethanol terminals in the South and Southeast. With this acquisition, POET increased its production capacity 40 percent to 3 BGPY, across 33 ethanol plants. The plants, located in Iowa and Nebraska, have a combined production capacity of 800 MGPY and broaden POET’s geographic footprint. Flint Hills, a subsidiary of Kansas-based industrial conglomerate Koch Industries, had bought the plants between 2010 and 2013.

- BioUrja acquired ADM’s ethanol production facility in Peoria, Illinois. As part of its strategic review of its dry mill ethanol assets, ADM sold its 135 MGPY plant in Illinois. The sale reduced ADM’s dry mill capacity 13% to 925 MGPY, across 3 ethanol plants. A Texas-based commodities firm, BioUrja made its first ethanol plant acquisition.

- Pilot Co.’s GreenAmerica Biofuels acquired Green Plains’ ethanol plant in Ord, Nebraska. GreenAmerica Biofuels acquired the 65 MGPY plant for $64M plus working capital. The transaction was another step for Green Plains to fund its strategy to construct and implement high-protein technology across its biorefining platform.

- Granite Falls acquired the remaining 49 percent ownership stake in Heron Lake BioEnergy’s ethanol plant in Heron Lake, Minnesota. With this $14M acquisition, Granite Falls, already an existing shareholder, now owns two plants in Minnesota with a total production capacity of 120 MGPY.

- Pelican Acquisition acquired Alto Ingredient’s ethanol plant in Stockton, California. Pelican, a California-based investment group, acquired the non-operating 60 MGPY plant for $24M in cash. The transaction helped Alto retire the remaining portion of its outstanding debt and further fund its transition from fuel-grade ethanol towards specialty alcohols. Pelican will produce renewable fuels at the site and develop a CO2 sequestration facility in the California Delta.

- Seaboard acquired Alto Ingredient’s ethanol plant in Madera, California. Seaboard picked up the non-operating 40 MGPY plant for $28.3M, comprised of $19.5M in cash and $8.8M in assumption of debt.

- Summit Agricultural Group acquired Prairie Horizon Agri-Energy’s ethanol plant in Phillipsburg, Kansas. The Iowa-based private equity firm will invest more than $200 million to construct a wheat protein ingredients plant and retrofit the 40 MGPY plant to produce ethanol from wheat starch and other products.

Biodiesel & Renewable Diesel M&A

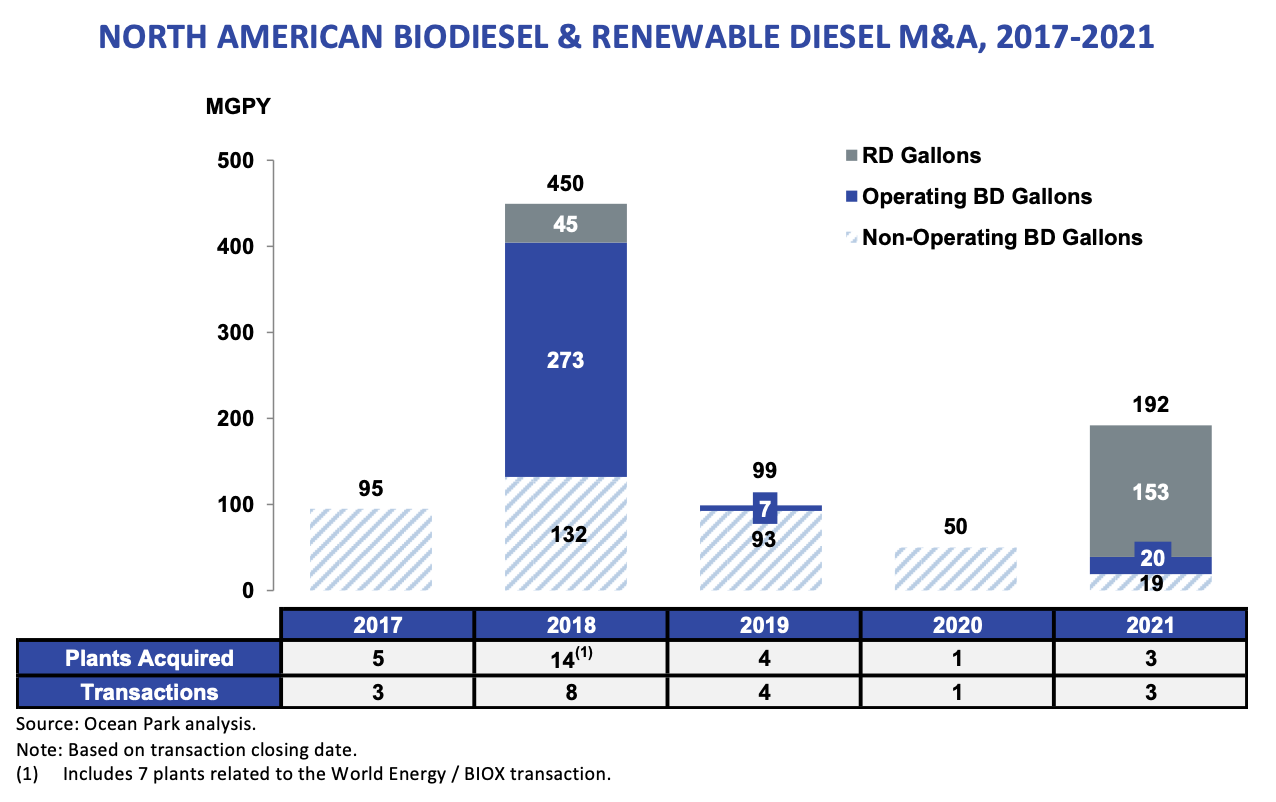

In contrast with ethanol, biodiesel and renewable diesel M&A remained sluggish in 2021. Deals, with one exception (the HollyFrontier/Sinclair deal to buy an RD plant in Wyoming), were limited to idle, non-operating or sub-scale plants for the third consecutive year.

The reason: The rapid growth of RD is taking market share and feedstock away from BD. Whereas RD capacity in the US more than tripled to 1.3 BGPY in 2021, BD production declined by 8% to 1.7B gallons.

Instead of buying biodiesel plants, companies deployed capital to renewable diesel projects and to secure feedstock for their plants. The largest soy oil producers are also the largest biodiesel producers. Last year, many of these firms notched deals with major oil companies to supply them with feedstock for their RD operations.

In some cases, it’s even become more profitable for vegetable oil producers to sell their oil to RD producers than produce biodiesel. Refer to boxes below on RD announcements.

There was one major deal and two minor ones, totaling a transfer of 192 MGPY capacity.

- The major one was HollyFrontier acquiring Sinclair’s renewable diesel plant in Sinclair, Wyoming. The Texas-based independent refining company acquired the operating 153 MGPY renewable diesel plant from Sinclair. With this acquisition, HollyFrontier grew its fleet to three plants with 380 MGPY of production capacity.

In two smaller deals:

- C&S Fuels acquired Scott Petroleum’s biodiesel plant in Greenville, Mississippi. The family-owned fuel distribution company acquired the 20 MGPY biodiesel plant along with a fuel terminal, bulk plants and convenience stores in Mississippi, Arkansas and Louisiana.

- Canary Biofuels acquired Invigor Bioenergy’s biodiesel plant in Lethbridge, Alberta, Canada. Following a $16.5M equity raise, Canary Biofuels acquired the non-operating 19 MGPY plant. Canary will also use proceeds from the financing to retrofit the plant to produce biodiesel from waste feedstocks.

2021 Major RD Construction Announcements

The key to understanding today’s biodiesel and renewable diesel market might be developments in renewable diesel construction and feedstock investments. Twelve companies announced or began construction of 2 BGPY of new capacity. Many of these projects will start up in 2022 leading to an even greater pull of feedstock into RD production.

- Diamond Green began construction of a 400 MGPY RD plant in Port Arthur, TX. The estimated cost of the project is $1.45B and is expected to be operational in 2023.

- REG began construction of a 250 MGPY expansion at its Geismar RD plant. The company completed a $335M equity raise during the year to fund the expansion.

- Seaboard began converting its cellulosic ethanol plant in Hugoton, KS to an 85 MGPY RD plant.

- Calumet began converting its refinery in Great Falls, MN to a 140 MGPY RD plant.

- CVR will move forward with plans to convert its refinery in Wynnewood, OK to a 100 MGPY RD plant, after previously delaying due to elevated feedstock costs. CVR is also eyeing a similar conversion at its refinery in Coffeyville, KS.

- PBF is considering a $550M investment to convert its Chalmette refinery unit to a 307 MGPY RD plant.

- Cargill and Love’s announced the formation of Heartwell Renewables, a 50-50 joint venture to construct an 80 MGPY RD plant in Hastings, NE. Operations are expected to start in 2023.

- Other announcements by Cresta Fund Management, Evolve Transition Infrastructure, Starwood Energy and Vertex Energy total 588 MGPY.

2021 Major RD Feedstock Announcements

The boom in RD construction has set off a battle for feedstock. The year 2021 witnessed a flurry of investments, joint ventures, and acquisitions by integrated oil firms, refiners and large energy companies aimed at controlling and boosting feedstock for RD plants. The scarcity of feedstock has made its sourcing and control as important as owning processing plants.

- Phillips 66 invested in a greenfield soybean processing plant in Shell Rock, IA that would provide 4,000 barrels per day of soybean oil for its RD plant in Rodeo, CA.

- ADM and Marathon announced an agreement to form a 75/25 joint venture where Marathon would invest in ADM’s soybean processing complex in Spiritwood, ND which will provide feedstock to its Dickinson RD plant

- Bunge and Chevron announced a proposed 50/50 joint venture to develop lower carbon intensity feedstocks where Bunge would contribute two soybean processing facilities in Destrehan, LA and Cairo, IL and Chevron would contribute $600M in cash.

- Neste acquired Agri Trading, a Minnesota-based trader of animal fats and oils.

- Tyson Foods and Jacob Stern & Sons formed a joint venture and started construction on a feedstock pre-treatment plant in Dakota City, NE.

- Darling acquired Valley Proteins, a renderer and recycler of waste with 18 facilities throughout the southern, southeast and mid-Atlantic regions of the US, for $1.1B.

- Global Clean Energy Holdings (GCEH) signed an MOU with ExxonMobil that further aligns the companies and includes a $125M investment from ExxonMobil. GCEH owns a leading camelina feedstock business and renewable diesel plant under construction in Bakersfield, CA.

- GCEH acquired Camelina Company España, Europe’s largest camelina company headquartered in Madrid, Spain.

North American Biofuels Outlook for 2022

Regulatory: After much delay, the Biden administration issued federal Renewable Fuel Standard proposed rulings for 2020, 2021 and 2022. These rulings reduced 2020 and 2021 Renewable Volume Obligations (RVOs), while slightly increasing the 2022 RVO and denying pending small refinery exemptions. While the RVOs might not have been as bullish as some industry participants had wished, they began to clear the logjam that had built up and caused ambiguity in the biofuels market.

The $1.00 per gallon biomass-based diesel tax credit (BTC) is set to expire at the end 2022 and will need to be renewed by Congress. Congressional proposals have been made to enhance the Section 45Q tax credits, which provide tax credits incentives to producers that capture and store or use carbon dioxide.

The counterweight to uncertain federal policy has been increasingly strong state support for biofuels, such as California’s Low Carbon Fuel Standard (LCFS) and Oregon’s Clean Fuels Program (CFP). Multiple other US states are also weighing similar programs. LCFS adoption in other states, and globally, would grow demand for renewable fuels and could encourage investment from strategic and financial parties.

Ethanol: Demand rebounded in the second half of 2021 which resulted in robust margins. Since the fourth quarter of 2021, ethanol overproduction has swollen inventories, shrinking margins. Ocean Park expects margins to remain volatile, with continued shifting of assets to new ownership willing to invest in transformation of the traditional ethanol business model. Examples of required transformation include decarbonization and diversification of product streams.

Biodiesel: In 2021, BD plants lost money because RD plants coming online boosted feedstock prices and made BD production unprofitable, and unclear policy direction created more risk. If these headwinds persist in the near-term, more plants could idle or shut down. Liquidations or distressed sales could be common in 2022. Independent BD plants without secured feedstock supplies will face heightened competition for feedstock from RD plants.

Renewable Diesel: Capacity is expected to grow by more than 50% to 2 BGPY in 2022. The rapid expansion underway is making feedstocks expensive and compressing margins. To mitigate these pressures, RD producers could pursue more deals to lock in feedstock supplies. Longer-term, factors that could potentially limit RD growth and investment include relatively static mandated volumes, limited feedstock, and the size of the California and Oregon mandated markets.

Conclusion

The entry of integrated petroleum firms into renewable diesel has opened a new chapter in the renewable fuel story.

The upshot: Often seen as antagonists, petroleum, renewable fuels and agricultural interests are finding ways to coexist, partner and co-invest

Perhaps the greatest near-term pressure will be on independent, non-feedstock aligned biodiesel producers in a feedstock-short environment dominated by the largest energy and agricultural companies.

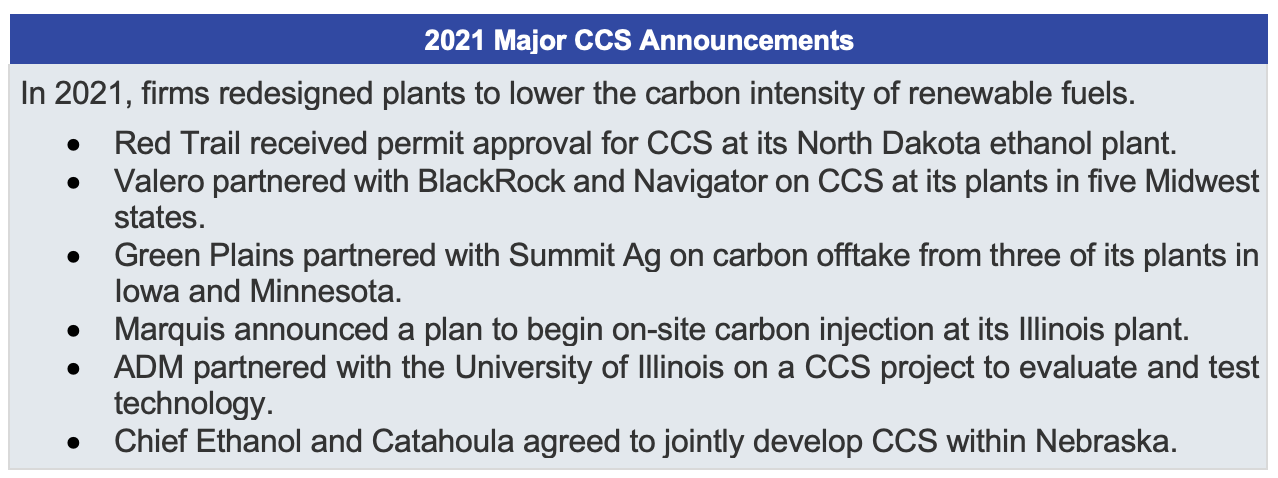

The year presented further examples of the strategic shifts by ethanol producers. As with the pivot to hand sanitizers at the onset of the pandemic, many ethanol producers in 2021 deployed capital to transition their products to higher-value specialty alcohols or ingredients, or invested in CCS initiatives to lower carbon intensity and increase value for their products. The industry continues to consolidate.

Similarly, in biodiesel and renewable diesel, many producers with capital looked to convert existing plants or refineries into more profitable RD plants, feedstock pretreatment and investments in new feedstock supply chains. As demand for biofuels and low-carbon supplies grow in the US and globally, the pressure on feedstock supplies will intensify.

About Ocean Park

Ocean Park is a leading boutique investment bank focused on the renewable fuels, energy, food, AgTech and agribusiness sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 80 transactions and client engagements, including over 30 biofuels transactions. Its professionals are based in Los Angeles, Houston, Minneapolis and Omaha. This material is solely for informational purposes. The information in this document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security or to provide any investment advice. Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.

Category: Thought Leadership, Top Stories