Purpose-Grown Energy Crops: What Drives Feedstock Innovation

By Glenn Farris, Managing Director, Lee Enterprises Consulting

Special to The Digest

In the drive towards a clean energy future and a low-carbon energy environment, purpose-grown energy crops will play a major role. At this time and for many years, researchers associated with universities, national labs, seed companies, and other institutions both public and private have been studying these crops and how they could be used as feedstocks for conversion into many clean energy products – products such as process heat, electricity, liquid fuels, and chemicals.

We use the term purpose-grown energy crops to describe this class of plants, and the universe of these plants is huge. It includes algae, herbaceous crops like switchgrass or miscanthus (see Figure 1), cover/intermediate crops (oilseed crops like pennycress or camelina), and short-rotation woody crops like willow or pine. Research on these feedstocks has been supported by the US Department of Energy’s Bioenergy Technologies Office (BETO). This backing has supported the study of these potential feedstocks in many ways, such as how are these plants grown, where they are grown, their yields, yield effects, and carbon cycle(s), as well as the economics of growing them, etc. Many test plots of these crops have been grown, and data has been collected over many years

Figure 1 Miscanthus Giganteus/Breullet Nature

Utilizing Marginal Lands for Profitable Growth

With all the information available, there are conclusions about the value of using these plants for feedstock. Two important facts stand out: 1) These crops can often be grown on marginal lands – lands that are hard, if not impossible, to farm economically for food. 2) Purpose-grown energy crops are highly productive – they produce more feedstock per acre than other feedstock sources, such as agricultural residues. In every state in the US, there are easily identifiable lands that are already out of farming because they are not economical to farm.

Even the most profitable farm can have specific portions of fields that are not profitable. Just as there is high variability from field to field, even within the same general area, using modern data collection we can show that there is high variability within a single field. In groundbreaking work at Iowa State University and our National Laboratory System, data generated with precision agriculture tools and publicly available mapping systems showed that in farm-rich Iowa, up to 5-20% of farm acres are consistently not profitable. When you add all these acres up, it means millions of acres currently farmed are not profitable. Generally, a field being farmed can be divided into 3 zones:

- Revenue zones: these are profitable using current agronomic approaches. All efforts should be geared towards maximizing the yields from these acres.

- Expense-limited zones: these areas require better expense management (e.g. irrigation, fertilizer, and herbicide application, etc.) to result in profitability.

- No-cost zones: where profitability is elusive no matter what is practiced or spent.

Conventional farming practices usually treat all areas of a field the same. The farmer will apply the same amount of water, nutrients, and pesticides to all areas of the field in the same amounts. However, this analysis leads us to the conclusion that substantial in-field variability means we should treat these areas differently.

If we focus on the no-cost zones, those areas will never be profitable with the existing crop (corn in many cases). Instead of not farming these areas, a case can be made to grow purpose-grown energy crops, which could return these no-cost zones to profitability.

Purpose-grown energy crops produce more energy per acre than many of our other available feedstocks. For example, in a high-yielding corn field, you might sustainably harvest around 2 dry US tons an acre of ag residue, such as corn stover. Miscanthus may easily yield more than 6 dry US tons per acre, or 3 times that of corn stover. I am not advocating that we turn highly productive corn-growing acres into energy crops, but for marginal or unproductive lands purpose-grown energy crops might be a viable and profitable enterprise.

Market Demand and American Farmers

Given the above information, the question to ask is why there isn’t a fully developed supply chain for these plants. In other words, with all the above drivers, why are we still researching how to develop a supply chain around these materials? The answer is fairly simple – who would use them? I would argue that if we can develop profitable conversion processes, the American farmer will plant, nurture, and grow these crops in response to profit-making.Some examples will make this point.

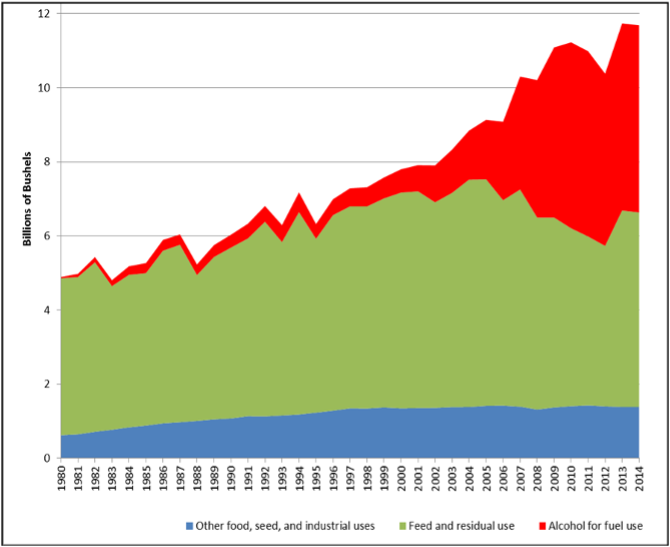

Figure 2 Corn Use in the US

Figure 2 above shows the corn crop production from 1980 through 2014. As one can derive from the chart, the planting of corn exploded starting around 2006 due to all the ethanol production projects built following the enactment of the Renewable Fuels Standard (RFS). The RFS was put in place with the passing of the Energy Policy Act of 2005, signed into law by then-President George W. Bush. Simply stated, the RFS requires transportation fuels containing certain volumes of renewable fuels. It also limited the use of petroleum-derived methyl tertiary butyl ether (MBTE) as an oxygenate additive, resulting in a large increase in demand for ethanol. These volumes were increased in the Energy Independence and Security Act of 2007. Another driving factor in the Energy Policy Act of 2005 was the removal of the oxygenate requirement for reformulated gasoline (RFG). This allowed refiners to remove methyl tertiary betyl ether (MTBE) from RFG. By this time, many states had banned the use of MTBE due to health and environmental concerns. The refiners, in most cases, replaced the MTBE with ethanol, which maintains or increases octane levels in RFG just like the MTBE. This short history of ethanol and legislation supporting its use explains the increase in corn production that supports the ethanol industry. Currently, approximately one-third of the corn produced in the US goes to the production of ethanol.

A second example of the development of the feedstock supply chain to address a market need is the use of miscanthus by the feed industry. Cellulose has been a source of non-soluble dietary fiber in pet foods for generations. It is produced as a byproduct of the paper-making process. However, for many reasons, the pulp and paper industry has become an unreliable source of cellulose for the pet food industry. Research conducted by Kansas State University found Miscanthus contains xylooligosaccharides (XOS), a prebiotic that can support digestive health, while powdered cellulose does not. It also found that fibers from Miscanthus performed on par with powdered cellulose from a functional nutrition perspective, in palatability, and during processing. Additional research at the University of Illinois showed that Miscanthus fiber can offer many gut health benefits for pets when combined with beet pulp or tomato pomace fibers. Why is this important? It is important because it has led to thousands of acres of Miscanthus being grown in response to this need. Renew Biomass has developed a feed ingredient called MFiber that is being used in pet food products. Miscanthus grass is being grown by over 150 farmers and processed into MFiber in a safe feed/safe food (SF/SF) facility by Renew Biomass in Aurora, MO. It is an all-natural, non-GMO product produced without the use of chemicals. A fascinating fact is that most farmers growing Miscanthus in Missouri had never even seen the plant prior to them starting to grow it.

Challenges in Bridging the Economic Gap

Clearly, the American farmer will respond to market demands. Does this mean the USDOE and or the USDA should not continue to support research into purpose-grown energy crops via funding opportunities? The short answer is no. We need to understand as much as possible about these crops – where they will thrive, how to maximize their yields, and what their optimum logistical supply chain looks like. Another area we need to understand fully is how we manage the economic bridge between the planting of these crops and the first harvest, which often is 2-3 years away. Farming is a risky business, and it is unlikely that row-crop farmers can last 2-3 years from first planting until the first harvest. Regardless, no matter how much we know about how to plant, nurture, harvest, and transport purpose-grown energy crops, this will not lead to the widespread growth of these crops. This will not happen until there are profitable markets available for the production and or conversion of these plants into products from these plants, just as in the case of Renew Biomass. The good news for the industry is that there are many biomass conversion projects in all phases of development or already under construction.

However, there is one thing the industry should be concerned about regarding the supply chain for feedstock. With a few project successes, the industry could see a rapid rollout of projects, just like the starch or grain ethanol industry did starting in 2005. If this comes to pass, the farm equipment industry could face a difficult time producing (in a short period) the additional thousands of pieces of equipment necessary to support the millions of tons of feedstock the industry will require. That will require an additional article to discuss all the headwinds ag OEMs may face to meet this demand, but rest assured it will not be the American farmer that holds the industry back.

About the Author

Glenn Farris was recognized in 2008 as one of the top five influential figures in North American renewable energy by European Institutional Investors Services, with over 25 years of experience in project development and biomass energy technology. Notably, he managed the Vermont Gasification Project, a groundbreaking public-private partnership with the US Department of Energy, which received the prestigious USDOE R&D 100 Award in 1998. Previously, as Director of Product Strategy for North America at AGCO Corporation, Glenn focused on optimizing the biomass supply chain for second-generation cellulosic biomass conversion. Currently serving as a Managing Director and a Project Director at Lee Enterprises Consulting, Glenn oversees matters of Biomass Power, Financing & Permitting, Cellulosic Biomass, Financial Modeling, Agricultural Waste, Project Management & Risk Assessment.

About Lee Enterprises Consulting

Lee Enterprises Consulting has over 180 experts that can help navigate your bioeconomy needs. If you need assistance with your bioenergy project(s), please Contact Us.

Category: Top Stories